As the tax season approaches, many people consider using tax preparation software to file their taxes. It has become increasingly popular over the years and for good reason.

However, like any other tool, it has its advantages and disadvantages. This blog will explore the pros and cons of tax preparation software.

The Benefits of Tax preparation software

Sharing my experience with tax preparation software, and how I benefited from using it. When I went to pay my taxes in 2023, using the tax software, it saved me time, I paid my taxes very quickly and easily without any errors. I was able to ensure that my tax return was filed correctly, easily, and at an affordable cost.

This software can provide numerous benefits to individuals and businesses. First and foremost, it can save time and money by automating the tax preparation process, reducing the risk of errors, and ensuring that tax returns are accurate and filed on time.

Additionally, tax software can help users identify potential deductions and credits, maximizing their tax savings. Many levy software programs also offer customer support, providing users with expert assistance and guidance throughout the tax preparation process.

Overall, tax preparation software can streamline the tax filing process and provide significant benefits for individuals and businesses alike.

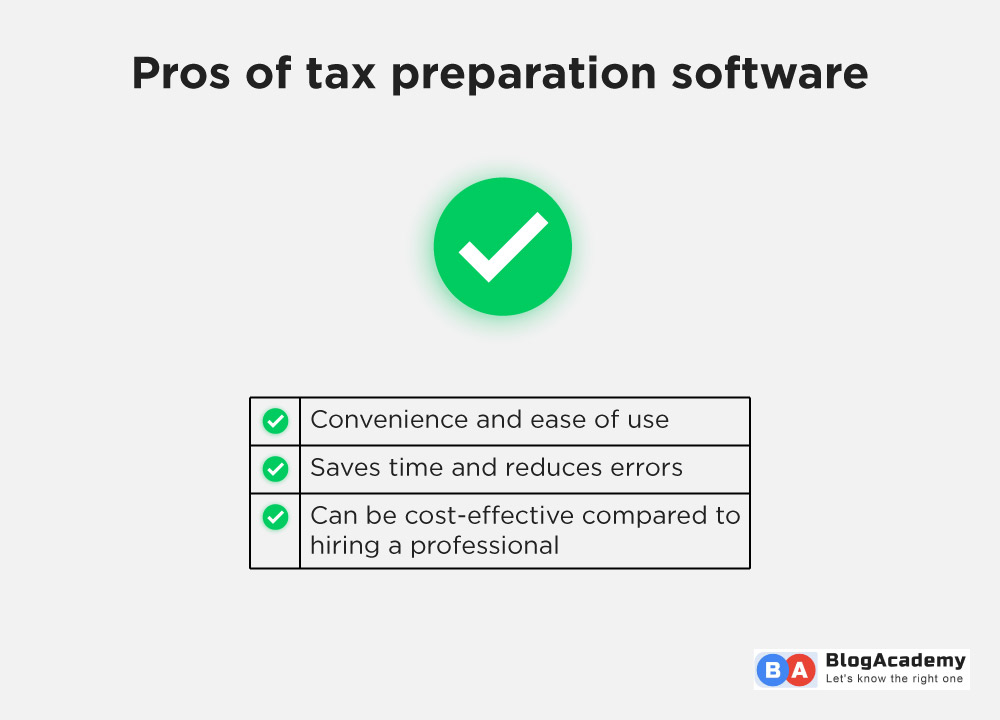

Pros of tax preparation software:

- Convenience and ease of use: It is user-friendly and easy to navigate, making it a convenient option for those who want to file their taxes without the help of a professional. The software guides you through the process, asking you relevant questions and offering explanations to ensure you understand each step.

- Saves time and reduces errors: Filing taxes can be a time-consuming process, and even a small mistake can cause significant problems. this software can save you time and reduce the likelihood of errors by automating calculations and checking for common mistakes.

- Can be cost-effective compared to hiring a professional: Hiring a professional tax preparer can be expensive, especially for those with simple tax situations. It is often more affordable and can save you money on preparation fees.

- Ability to file taxes electronically and get refunds faster: It allows you to file your taxes electronically, which can result in a faster refund. The software can also help you track the status of your refund, giving you peace of mind.

- Provides access to updated tax laws and regulations: Tax laws and regulations can be complex and change frequently. It is often updated with the latest tax laws and regulations, ensuring that you are filing your taxes accurately.

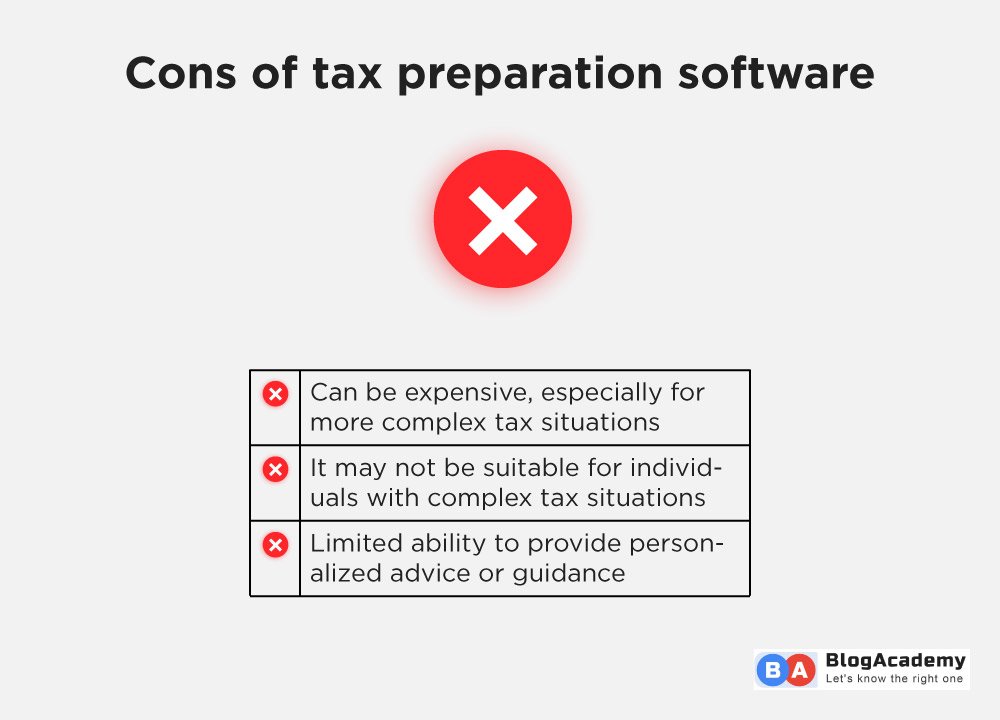

Cons of tax preparation software:

We are clear about the Pros of tax preparation software. Right now we will discuss about what are the cons of tax preparation software.

- Can be expensive, especially for more complex tax situations: While tax software is often more affordable than hiring a professional, it can still be costly, especially for those with complex levy situations. Some software providers charge additional fees for state returns or to file more than one tax return.

- It may not be suitable for individuals with complex tax situations: This software may not be the best option for those with complex tax situations, such as business owners or those with multiple sources of income. In these cases, hiring a professional tax preparer may be best.

- Limited ability to provide personalized advice or guidance: It is designed to provide general guidance, but it may not be able to provide personalized advice or guidance for your specific tax situation. If you have questions or concerns about your taxes, you may need to seek advice from a tax professional.

- May not catch all errors or deductions that a human tax preparer could: While tax preparation software can help reduce errors, it may not catch all errors or deductions that a human levy preparer could. Human tax preparers can use their expertise and experience to identify deductions and credits that the software may miss.

- Security concerns with storing sensitive personal information: Tax preparation software requires you to provide sensitive personal information, such as your social security number, income, and deductions. There is always a risk of data breaches or identity theft, so it’s essential to choose a reputable software provider and take precautions to protect your information.

Software packages

Tax preparation software packages are computer programs designed to assist individuals and businesses in preparing their levy returns. These packages typically offer features such as automatic calculations, error checking, and electronic filing options.

Some popular tax preparation software packages include TurboTax, H&R Block, and TaxAct. These packages often come in different versions, such as basic, deluxe, and premium, with varying levels of support and features.

While this software can be a helpful tool for many people, it is important to note that they are not a substitute for professional tax advice and may not be suitable for complex tax situations.

Forbes Best Tax Preparation Software Companies

There are many tax preparation software companies that offer tax preparation services to individuals and businesses. I can tell you some of the top companies that were included in Forbes’ list.

- TurboTax: TurboTax is a user-friendly software that offers various packages to cater to the needs of different users. It provides step-by-step guidance throughout the tax preparation process and has a user-friendly interface.

- H&R Block: H&R Block is another popular tax preparation software that offers online and in-person services. It has an easy-to-use interface and offers various packages to suit different needs.

- TaxAct: TaxAct is a reliable software that offers affordable packages for users. It has a user-friendly interface and offers various features that make the tax preparation process more manageable.

- TaxSlayer: TaxSlayer offers various packages to cater to the needs of different users. It provides step-by-step guidance throughout the tax preparation process and has an easy-to-use interface.

- Jackson Hewitt: Jackson Hewitt offers both online and in-person services. It provides various packages to cater to the needs of different users and has a user-friendly interface.

It’s important to note that each software company has its own features, pricing, and user experience It’s always a good idea to do your own research before choosing tax preparation software.

Conclusions:

Tax preparation software can be a convenient and cost-effective option for many individuals. However, it’s important to carefully review and compare different options before choosing software.

This software may not be suitable for everyone, especially those with complex levy situations. It’s essential to weigh the pros and cons carefully and make an informed decision based on your specific needs and circumstances.

Youre so cool! I dont suppose Ive read something like this before. So nice to find anyone with some unique ideas on this subject. realy thank you for beginning this up. this web site is one thing that is needed on the web, somebody with a little bit originality. useful job for bringing something new to the web!

You should participate in a contest for among the best blogs on the web. I’ll recommend this web site!

you could have an important weblog right here! would you prefer to make some invite posts on my weblog?

It is best to take part in a contest for one of the best blogs on the web. I will suggest this site!